GLOBAL DIGITAL GROUP

Building the Future $1B+ Digital Leader, Together.

Overview of our vision for founders and investors

Written by Jakub Jablonsky

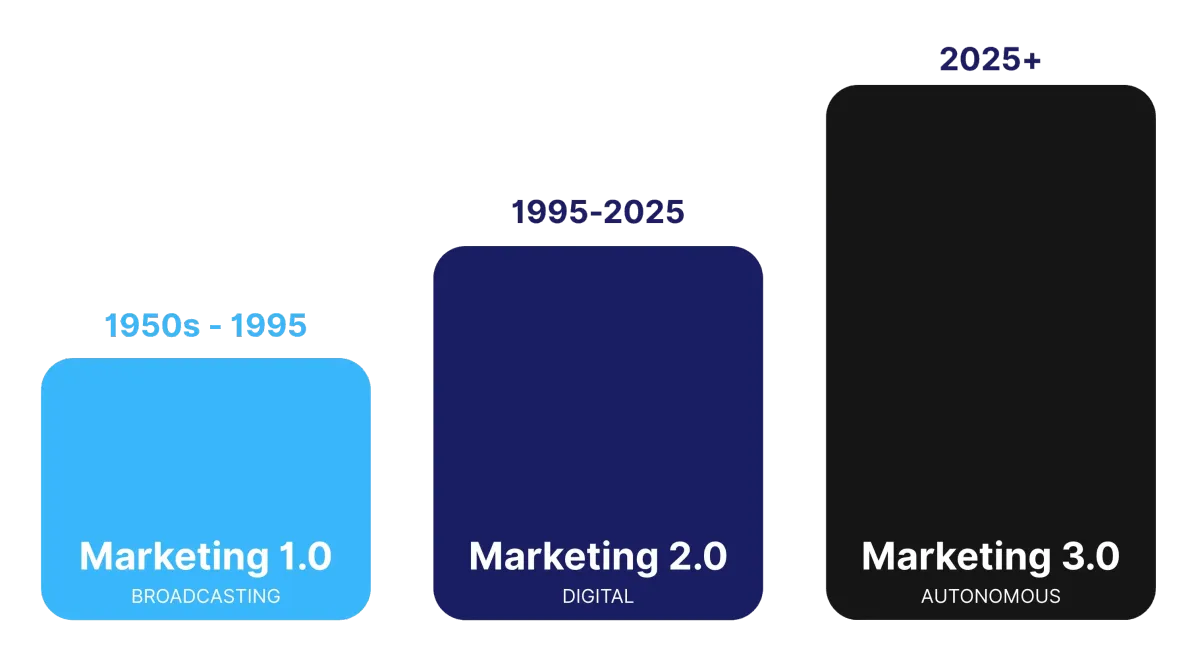

Marketing 1.0 (Broadcasting): TV, Radio, Print ads, Billboards

- One way messages to mass audience, Build broad brand awareness and reach

Marketing 2.0 (Digital): SEO, SEM, Social media ads, Email, Influencers, Chatbots

- 2-way interaction begins (comments, shares), targeted reach, clicks, conversions, leads

Marketing 3.0 (Autonomous): Agent Engine Optimization (AEO), VR/XR, Conversational AI agents, Hyper personalization, AI-driven autonomy and decisioning

I decided to write this letter, instead of slide decks as I feel it's more personal.

You're likely reading this as you have a business in the marketing or digital space.

...and you've likely hit impressive milestone — $3m, $5m, $10m in revenue. Maybe much more.

But getting to the next level feels different, right?

What's next at this stage?

Most business owners I speak to at this stage are in these 2 categories:

1) Have ambition to grow further — getting larger contracts, A-player employees, or need more capital to grow

2) Want to capitalize on what they've built — and get paid for years of hard work

...but how do you best achieve either of these goals?

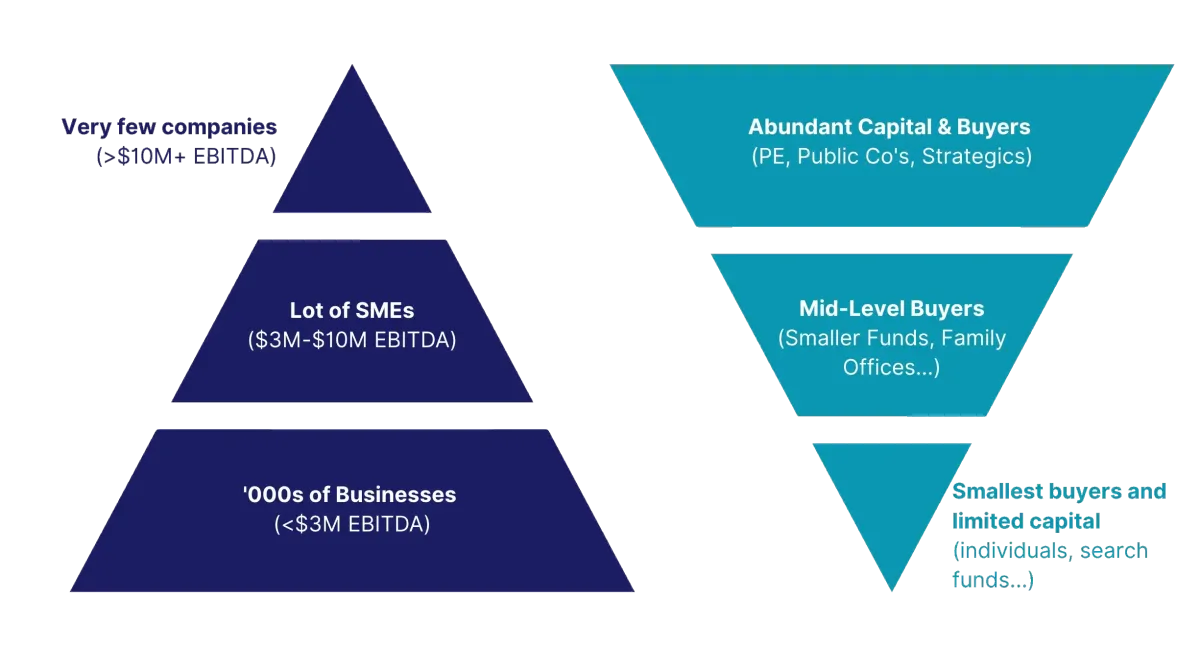

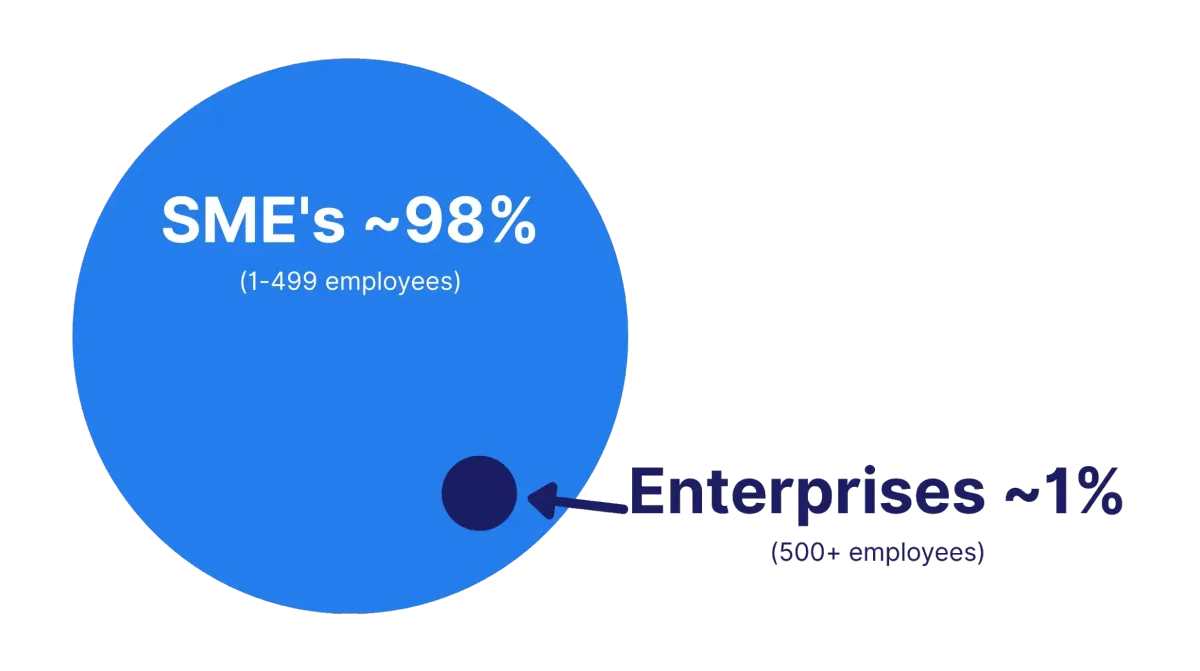

Challenge for "small" $500k-$5m profit companies

If you're between $500k-$5m profit, the pool of buyers you can sell your company to is very limited...

The buyers with the most capital (PE, Public Co's) often focus on much larger deals ($5-10M+ profit).

This means fewer or no serious acquirers, often resulting on lower valuation and multiples.

...and the buyers you typically get have no idea how to run and grow your specific business.

"You become wealthy by selling a business, not by running it."

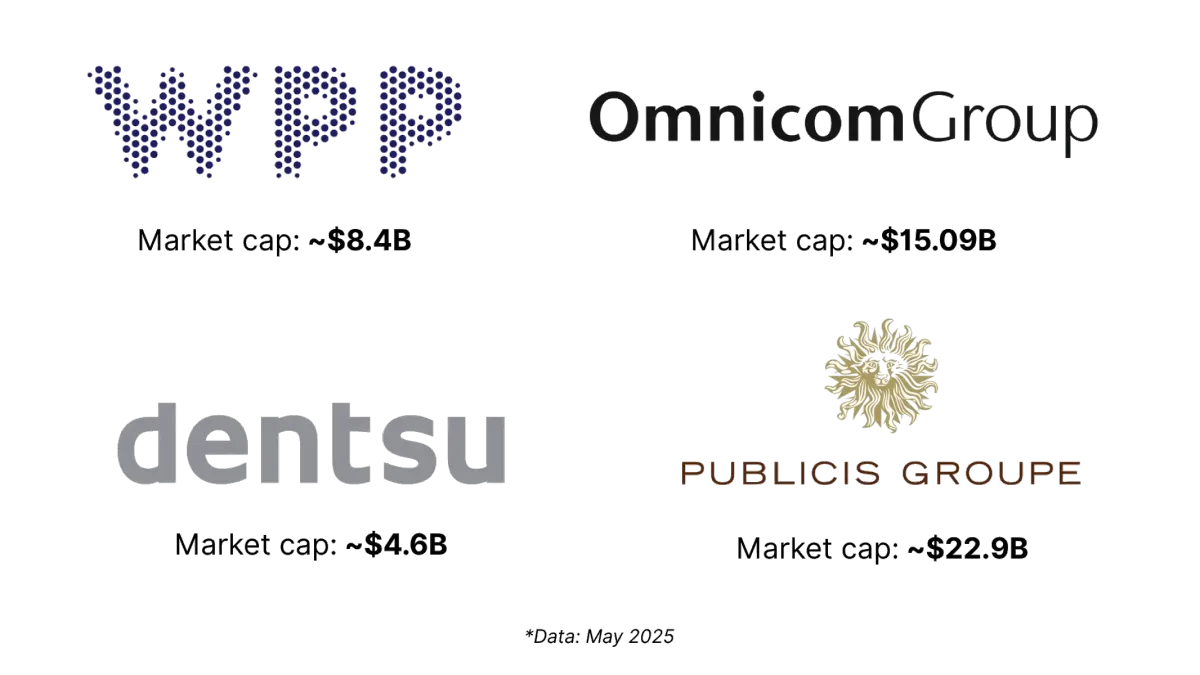

How do companies reach $1B+ in our industry?

The lesson is clear:

If we want to build something truly huge in our industry ($100m+, $1B+, $10B+), the group structure is proven way the biggest players have done it.

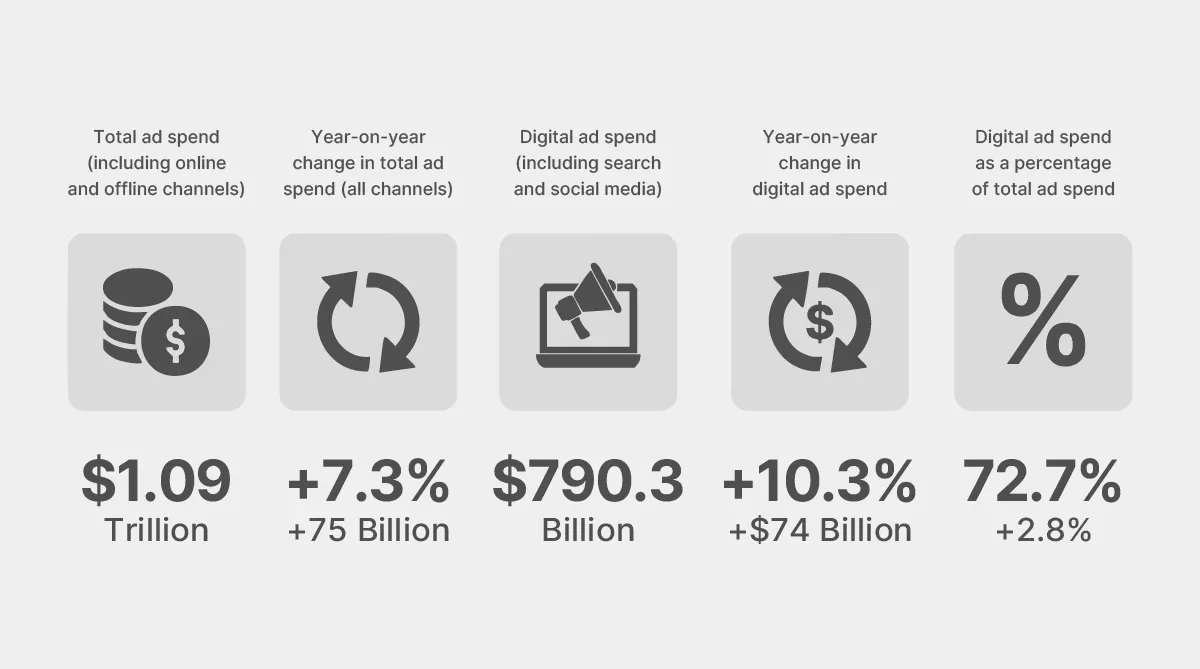

The ad market is huge ($1.09T annual global ad spend*) but can you capture it?

The challenge of capturing large chunk of this market is similar to getting buyers for your company...

Small number of companies capture the majority of the market —

and most independent companies end up working with "low" budget clients.

Source: Grok Deeper Search - accessible data for NAICS 54

Bigger clients pay better, spend more and are typically easier to deal with...

But delivering great and consistent results, while not being dependent on few key large clients is tough with limited resources (team, cash...)

The opportunity

GROUP PARTNERSHIP MODEL™ inside a Public Hold Co.

Build a leading group of these expert providers to better serve this trillion-dollar market through shared scale & technology.

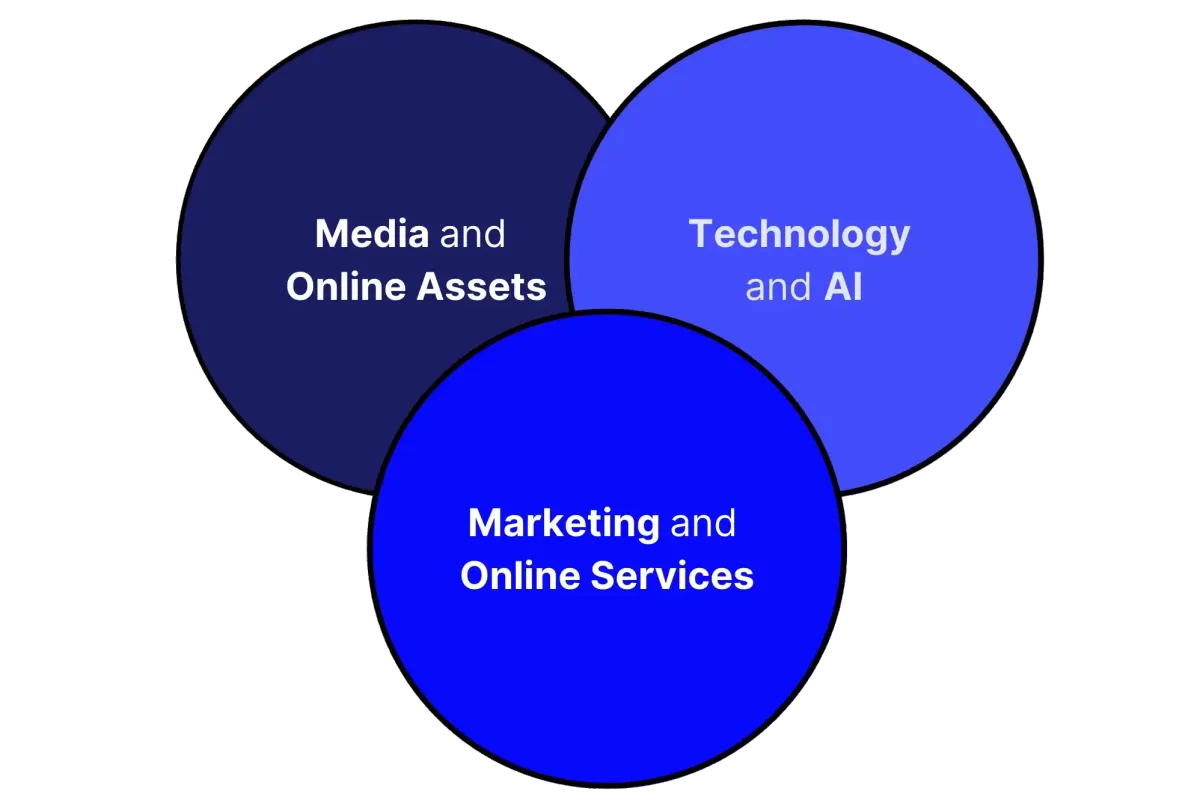

WE ACQUIRE OR PARTNER WITH COMPANIES IN THE MARKETING ECOSYSTEM:

Target: Marketing Ecosystem

EXAMPLES OF BUSINESSES THAT ARE JOINING OUR PUBLIC GROUP

Services

Marketing agencies

Development agencies

Sales agencies

AI and IT services

Technology & AI

MarTech

Data solutions

AI and Software

Media

Lead generation and affiliate brands

Content publishers / authority brands

Communities

How does it work?

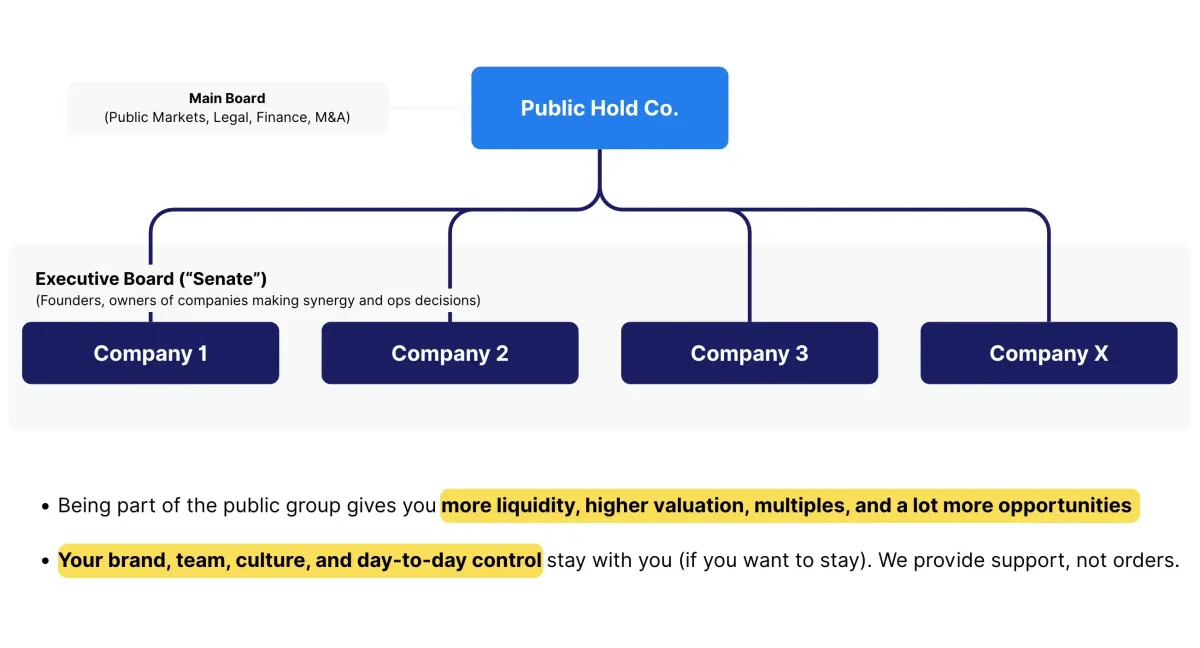

Our approach uses the GROUP PARTNERSHIP MODEL™ to create a Holding Company listed on a public stock exchange.

This public structure serves as the vehicle for our M&A strategy and helping founders exit.

We will initially list on the Düsseldorf and Frankfurt exchanges in Germany – collectively the world's 4th largest exchange system.

Our goal is to reach a $1-$2 Billion market cap, at which point we plan to uplist to the NASDAQ to access deeper liquidity and further growth opportunities.

I am (Jakub) providing the initial funding for anything required (audits, legal, exchange fees etc.) and listing my company first.

Example of public structure

What are the benefits for founders within our group or acquired by us?

Being part of a public company, rather than a private one, makes certain things more accessible.

Here are a few examples:

Personal wealth

• Higher valuation and multiples

• Access sophisticated financial options (e.g., private banking)

• Build diversified wealth beyond a single private company - being part of group eliminates risk of single company failure

Liquidity

• Turn your company ownership into cash or public shares/bonds you can actually use or sell later

• Get paid for the value you've built (you make real money when we sell, not when we run the company)

Grow through acquisitions

• You will be able to grow your company by M&A

Bigger clients

• Win larger contracts and have way more credibility

• Get client leads passed between partner companies

Better talent

• Compete for talent you probably can't land today

• "A-players" see more opportunity in a bigger, growing group

Control

• No BS integrations, your company keeps its brand and culture

Global expansion

• Makes expanding into other countries easier

• Tap into the group's connections or presence abroad

Succession

• Planning a leadership transition is often smoother within a group that understands your business, compared to finding an outside buyer alone.

• Avoid selling to strangers who might not care about your team and customers

Capital access

• Access capital when you need it for big ideas (new hires, acquisitions, tech)

• Fund the things that make your company worth more

Being around top founders

• Find ways to work together and send business to each other

• You join a network of experienced founders running similar businesses – a valuable resource for advice and collaboration

Q: What if you don't want to go public and just exit?

We can structure the deal in any way that will work for your current goal.

Many founders (typically in the later stage of careers or with families) don't care about going public and just want to exit and get paid.

The key benefit is still partnering with industry operators who understand your business and prioritize its future – often a safer bet for your team and clients than selling to typical PE or random buyers. We can build a deal around what works for you.

THE GOAL

Our target is $1B market value in 3-4 years

Targeting $50m-$100m combined group EBIT to support this valuation.

(public companies trade at higher multiples)

Timeline for execution

We actively source and evaluate ~300-320 potential partners each month.

Our current qualified pipeline (companies meeting initial criteria and worth exploring further) already represents over $50m in combined annual EBIT.

Why it matters for you?

As a partner holding public shares (if you decided to go that route), you directly benefit in achieving this goal and the value created.

OUR ACQUISITION CRITERIA

Is selling or partnering with us a good fit for you?

While we are open to discussing any opportunity, our preferred businesses are categorized below.

Exceptional business

• Consistent 3+ years of EBITDA between $1.5m-$2.5m or more

• Revenue and profit are growing steadily, often 15-20% or more yearly

• Clearly one of the top players in your specific niche, with a great reputation

• Experienced leadership team, eager to grow even more

Good business

• Profitable, making at least $500k in profit (EBITDA) annuall

• You (the founder/owner) are open to partnership and/or looking for a way to exit or transition leadership over time

• Stable business with a good reputation and regular clients

Likely not a fit

• Unprofitable, losing money or facing major money issues

• Mainly a solopreneur operation without a team

(we can discuss private transaction or Non Exec to help)

Your other options

Comparison with other business buyers

Our Model

Private Equity

Strategic Acquirer

(e.g., WPP, Omnicom)

Founder control

You keep operational control, run day-to-day business (if you want to stay)

Significant oversight; decisions driven by PE board/financial targets.

Limited autonomy; integrated into corporate structure & processes.

Deal flexibility

High: Structure mix of cash, public shares, bonds, earn-outs to fit your goals.

Moderate: Often leverage buyout with earnout structure, complex terms tied to fund structure/exit.

Often cash buyout and complex earn-outs tied to integration targets. Less flexibility.

Getting your money out

Access liquidity via cash/shares upfront AND potential future upside via public stock.

Primarily liquidity upfront; future upside often limited or dependent on PE's exit success.

Usually full liquidity upfront; little/no participation in future upside.

Team & culture impact

Designed to preserve your team & culture; partner with industry peers.

Typically professional management put in place; culture often shifts significantly towards PE's financial focus & reporting.

Culture usually absorbed or replaced by the larger corporate environment.

Long term outlook

Long-term partnership focused on building the group value together.

Defined exit timeline (typically 3-7 years); focus is on fund returns

Focus is on integration and how your unit serves the parent company's goals.

Time to close a deal

2-4 month process

3-12 month process

3-12 month process

Founder control

Our Model

You keep operational control, run day-to-day business (if you want to stay)

Strategic Acquirer

(e.g., WPP, Omnicom)

Significant oversight; decisions driven by PE board/financial targets.

Private Equity

Limited autonomy; integrated into corporate structure & processes.

Deal flexibility

Our Model

High: Structure mix of cash, public shares, bonds, earn-outs to fit your goals.

Private Equity

Moderate: Often leverage buyout with earnout structure, complex terms tied to fund structure/exit.

Strategic Acquirer

(e.g., WPP, Omnicom)

Often cash buyout and complex earn-outs tied to integration targets. Less flexibility.

Getting your money out

Our Model

Access liquidity via cash/shares upfront AND potential future upside via public stock.

Private Equity

Primarily liquidity upfront; future upside often limited or dependent on PE's exit success.

Strategic Acquirer

(e.g., WPP, Omnicom)

Usually full liquidity upfront; little/no participation in future upside.

Team & culture impact

Our Model

Designed to preserve your team & culture; partner with industry peers.

Private Equity

Typically professional management put in place; culture often shifts significantly towards PE's financial focus & reporting.

Strategic Acquirer

(e.g., WPP, Omnicom)

Culture usually absorbed or replaced by the larger corporate environment.

Long term outlook

Our Model

Long-term partnership focused on building the group value together.

Private Equity

Defined exit timeline (typically 3-7 years); focus is on fund returns

Strategic Acquirer

(e.g., WPP, Omnicom)

Focus is on integration and how your unit serves the parent company's goals.

Time to close a deal

Our Model

2-4 month process

Private Equity

3-12 month process

Strategic Acquirer

(e.g., WPP, Omnicom)

3-12 month process

TEAM

Leadership & advisors

200+ M&A transactions completed, 6 public companies

10+ experience in marketing, sold 1st business at 19, PE & Debt at HBS, VP at $70m VC fund, Investor in companies valued at $1.1B

Jeremy Harbour

100+ M&A acquisitions, 5 public companies, Investor, Best selling author, Agglomeration™ model inventor

Calum Laing

$0-$230m marketing group in 3 months (NASDAQ), Partner at Unity Group, 100+ M&A transactions

Next steps

FOR FOUNDERS & BUSINESS OWNERS

To discuss the opportunity about joining the group or selling the business click the button below:

Or email [email protected]

OUR PROCESS

What's the process?

Here's what to expect moving forward

FAQ

Frequently asked questions

Deal structure

How exactly does the deal structure work?

We structure deals individually using various tools: this could involve cash, our public group shares, earn-outs based on future performance, bonds/loan notes, or even structures involving outside investors or leveraged buyout (LBO) principles if appropriate for the situation.

The aim is always to find a structure that makes sense for you and aligns our long-term partnership.

How do you determine the valuation for my company? What multiples are you using?

We look at standard factors: your consistent profit (EBITDA), growth rate, market position, and comparable company sales.

But it's not just a formula – we also value your team, potential, and how you fit strategically within the group.

We aim for fair valuations that reflect your success and offer significant upside through the partnership.

What are the tax implications for me personally when I exchange my private shares for public ones?

Tax situations are very individual. We strongly recommend you discuss this with your own tax advisor, as it depends on your jurisdiction.

Depending on the specific deal structure and your circumstances, receiving shares or deferred payments can sometimes offer better tax treatments compared to an all-cash sale, but only your advisor can give you qualified guidance.

What happens if the public HoldCo stock price goes down after I join?

The way we manage partner liquidity is different from typical retail stock trading.

We handle share sales only through an approved broker to meet required free-float rules and facilitate orderly transactions for partners over time.

This managed process helps insulate partners from extreme short-term volatility you might see in the open market and aims for more stable selling opportunities based on the company's underlying performance and value, rather than just daily market noise.

The focus remains on building the long-term value of the group based on strong combined profits (EBITDA).

Can we do a deal where I sell a majority but still retain a significant minority stake in my own company plus get HoldCo shares?

We're focused on partnership and flexibility.

While our standard model involves acquiring a majority stake, we're open to discussing structures that achieve your goals, including potentially retaining some direct ownership if it aligns with the overall group strategy and ensures clear alignment.

Is this "Group Partnership Model" a common or proven structure? Are there other examples besides the big holding companies?

The underlying strategy – building a larger, successful group by acquiring and partnering with strong, specialized companies – is a well-proven model used across many industries globally, often called 'buy and build' or similar terms.

The giants in our own industry, like WPP and Omnicom, grew this way.

We've simply named our specific founder-focused implementation the "Group Partnership Model".

We're applying a tested, successful strategy adapted for the unique dynamics of the marketing ecosystem.

If I get shares in the public HoldCo, what are the lock-up periods? When can I actually sell them?

Yes, similar to most acquisitions involving stock or IPOs, there will be standard lock-up periods on the shares you receive if you decide to go that route.

This is typical to ensure market stability.

The exact terms depend on the deal and listing rules, but are designed to align long-term interests.

We can discuss phased liquidity options over time.

Operations & control

What decisions does the HoldCo actually make or influence? What reporting is required?

HoldCo focuses on high-level strategy, supporting M&A, managing public company finances/compliance, and providing access to capital/resources.

Reporting is mainly standard financial consolidation needed for the public group – we're not here to micromanage your operations.

What happens if my company's performance dips after joining the group?

We're partners. If challenges arise, the goal is to work together.

You can tap into the peer network for advice, potentially leverage group resources, or get strategic input.

It's about collaboration to get back on track, not punishment.

How are synergies actually created? Is collaboration forced, or incentivized?

Synergies come from working smarter together.

We facilitate, not force, collaboration through our founder network.

Concrete examples include potential cost savings via group purchasing, shared access to expensive tech platforms, and generating leads through cross-referrals.

We incentivize working together where it makes sense.

What if I want to leave or step back from running my company a year or two after joining? How does that process work?

That's often easier within our group. We support planning smooth transitions.

You can potentially identify and groom successors internally or tap into the group's network of experienced operators who understand the business – providing a much better path than trying to find an outside replacement alone.

About us & execution

What is the primary source of your funds to acquire companies?

The initial setup and first acquisitions are from own funding from the business we already own. Most of the business Jakub's owns are cashflow generating in 7-8 figures.

Once the Holding Company is listed, our public shares become the primary 'currency' for partnerships, supplemented by group cash flow, bonds and potentially other financing for larger opportunities down the road.

Have your core team successfully executed this type of acquisition and integration strategy before? What's your track record?

Yes. Our team & advisors executed over 200+ M&A transactions and listed 6 companies on public exchanges (including NASDAQ, Frankfurt, London and Vienna)

What are the biggest risks to achieving the $1B+ goal in 3-4 years? What happens if you miss the M&A targets?

Key ones include market conditions affecting valuations, integration challenges as we grow, and simply executing our partnership plan consistently.

We mitigate these through disciplined selection of partners, focusing on collaboration, experienced leadership, and building a diversified group not reliant on any single company.

Specific scenarios & comparison

My goal is to grow significantly over the next 2-3 years and then get the best possible exit valuation. How does partnering now help me achieve that goal, potentially getting me a better final price than selling independently later?

Partnering now accelerates that growth.

You get capital, resources, and credibility to reach a larger scale faster than alone. Then, when you eventually seek liquidity via your public shares, you're doing so based on a potentially much larger, more valuable company that typically commands higher valuation multiples in the public market than a smaller private firm could achieve, even after growing.

It can be like getting two bites of the apple – uplift + growth participation.

How is this fundamentally different or better for me than selling to a good Private Equity firm that also provides capital and expertise?

Key differences:

1) Control: You can keep operational control; PE typically replaces you completely.

2) Flexibility: Our partnership is adaptable; PE often has a rigid playbook and 3-5 year exit timeline.

3) Focus: We're industry operators focused on long-term partnership; PE focus is primarily financial returns for their fund.

4) Alignment: We're building one group together; PE goals may differ from yours long-term.

How does this differ from just selling directly to one of the larger strategic groups (like a smaller WPP subsidiary)?

Often comes down to:

1) Autonomy: You typically retain significantly more day-to-day control and brand identity with us vs. being integrated into a large corporate structure which typically slows down decision making.

2) Upside: You directly share in the potentially higher growth and value creation of our focused group via public shares, rather than being a small part of a giant corporation.

3) Peer Network: You gain direct access to collaborate with fellow founder-leaders.

Get acquired now

To discuss the opportunity about joining the group or selling the business click the button below:

Or email [email protected]

Not an Offer to Sell or Solicitation: This document and page is for informational purposes only and does not constitute an offer to sell or a solicitation of an offer to buy any securities in our public company or any related entity, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. Any offering of securities will be made only by means of a legally compliant prospectus or offering memorandum.

Forward-Looking Statements: This document contains forward-looking statements regarding our plans, objectives, goals, strategies, future events, future revenues or performance, capital expenditures, financing needs, plans or intentions relating to acquisitions, and other information that is not historical information. These statements are based on current expectations, estimates, forecasts, and projections and involve known and unknown risks, uncertainties, and other factors that may cause our actual results, performance, or achievements to differ materially from any future results, performance, or achievements expressed or implied by these forward-looking statements. Potential risks and uncertainties include, but are not limited to: market conditions affecting the valuation of public companies; the ability to successfully identify, acquire, and integrate partner companies; competition in the marketing services industry; changes in technology and client demands; regulatory changes in Germany, the EU, or other relevant jurisdictions; ability to access capital markets; ability to retain key personnel; and general economic conditions.

No Guarantee: There can be no assurance that the proposed transactions, listings, financial targets (including market capitalization and EBIT targets), or strategic goals described herein will be successfully completed or achieved, or that the anticipated benefits will be realized. Past performance is not indicative of future results.

Reliance on Information: This document is provided for discussion purposes only. Recipients should not rely on this information as the sole basis for any investment or partnership decision. Recipients should conduct their own independent analysis, due diligence, and assessment of our company and the information contained herein.

No Advice: The information contained in this document does not constitute investment, legal, tax, or other professional advice. Recipients should consult with their own professional advisors regarding the appropriateness of any potential investment or partnership.

Jurisdictional Considerations: This document is not intended for distribution to, or use by, any person or entity in any jurisdiction or country where such distribution or use would be contrary to law or regulation. Specific regulations in Germany (including BaFin requirements) and the EU govern communications related to potential public offerings.

Confidentiality: This document and the information contained herein are confidential and are provided solely for the information of the intended recipient. Any reproduction or distribution of this document, in whole or in part, or the disclosure of its contents, without the prior written consent of JBLN Group is prohibited.

Copyright 2025. JBLN GROUP

© 2025 JBLN GROUP. All rights reserved.